- Afrikaans

- Albanian

- Amharic

- Arabic

- Armenian

- Azerbaijani

- Basque

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Catalan

- Cebuano

- Corsican

- Croatian

- Czech

- Danish

- Dutch

- English

- Esperanto

- Estonian

- Finnish

- French

- Frisian

- Galician

- Georgian

- German

- Greek

- Gujarati

- Haitian Creole

- hausa

- hawaiian

- Hebrew

- Hindi

- Miao

- Hungarian

- Icelandic

- igbo

- Indonesian

- irish

- Italian

- Japanese

- Javanese

- Kannada

- kazakh

- Khmer

- Rwandese

- Korean

- Kurdish

- Kyrgyz

- Lao

- Latin

- Latvian

- Lithuanian

- Luxembourgish

- Macedonian

- Malgashi

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Myanmar

- Nepali

- Norwegian

- Norwegian

- Occitan

- Pashto

- Persian

- Polish

- Portuguese

- Punjabi

- Romanian

- Russian

- Samoan

- Scottish Gaelic

- Serbian

- Sesotho

- Shona

- Sindhi

- Sinhala

- Slovak

- Slovenian

- Somali

- Spanish

- Sundanese

- Swahili

- Swedish

- Tagalog

- Tajik

- Tamil

- Tatar

- Telugu

- Thai

- Turkish

- Turkmen

- Ukrainian

- Urdu

- Uighur

- Uzbek

- Vietnamese

- Welsh

- Bantu

- Yiddish

- Yoruba

- Zulu

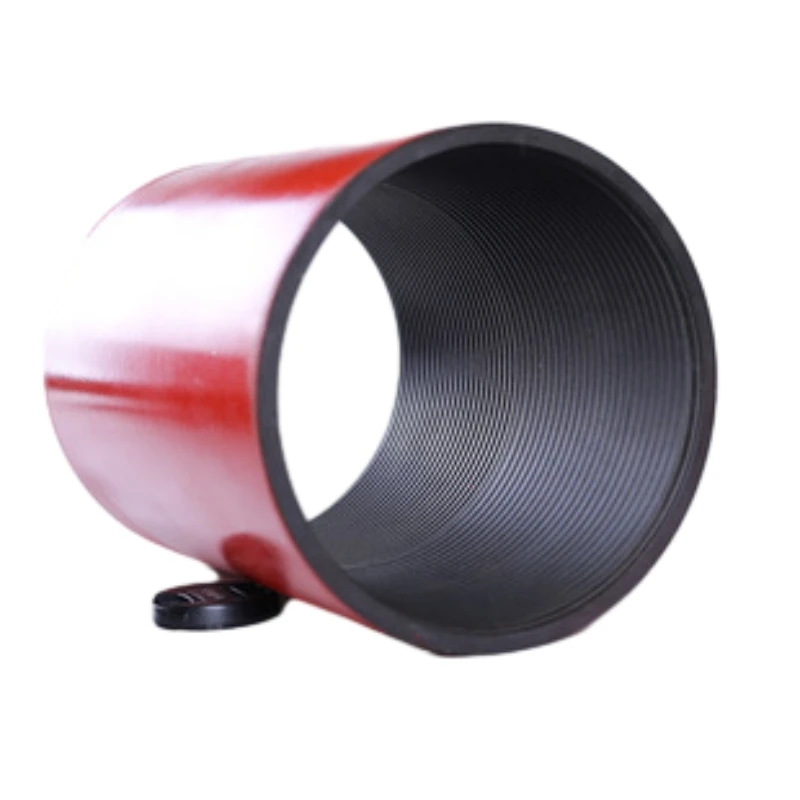

5 16 union coupling

Understanding the 5% 2016 Union Coupling A Deep Dive

In the realm of finance and investment, various metrics and indicators are used to analyze market behaviors and trends. One such metric that has garnered attention is the 5% 2016 union coupling. While this phrase may sound complex at first glance, it can be broken down into more digestible components that highlight its significance and applications.

What Does 5% 2016 Union Coupling Mean?

To begin with, let’s dissect the phrase. The 5% refers to a percentage that often signifies a threshold, a return rate, or an expected growth figure within a financial context. The year 2016 pinpointed here indicates a specific time frame that often serves as a benchmark for analyzing trend developments or changes in financial environments. Lastly, union coupling is a concept that can relate to the joining of different financial instruments or market segments.

The concept of 5% 2016 union coupling could be interpreted in several contexts ranging from investment portfolios to economic unions. In the investment landscape, it could denote a strategy that aims for a 5% return by combining different assets or types of investments, initially analyzed or popularized around 2016.

The Historical Context

The year 2016 was significant in the financial world for many reasons, not least because it witnessed a variety of market shifts, geopolitical events, and economic policies that influenced investor behavior. The aftermath of the 2008 financial crisis was still being felt, and investors were keen on implementing strategies that ensured a resilient portfolio. In light of this, the concept of union coupling emerged – this strategic blending of asset classes aimed to mitigate risk while optimizing potential returns.

Investors began identifying that traditionally uncorrelated assets, such as stocks and bonds, could work synergistically to create a more balanced and less volatile portfolio. Therefore, a 5% return target represented a reasonable and achievable goal in uncertain times.

5 16 union coupling

The Mechanics of Investment Strategy

At its core, the union coupling strategy revolves around diversification. By combining different asset classes and investments, investors can protect themselves from the inherent risks of any single investment. During 2016, with global markets experiencing fluctuating conditions—characterized by uncertainties like Brexit and U.S. election dynamics—investors were compelled to rethink their strategies.

The 5% target became emblematic of a cautious yet optimistic approach to investing. This percentage not only served as a benchmark for assessing performance but also represented a psychological anchor against the backdrop of market volatility.

Risks and Considerations

Like any investment strategy, 5% 2016 union coupling carries inherent risks. Investors adhering to this approach must remain vigilant about market changes. For instance, shifts in economic policy, interest rates, and global events can affect the performance of coupled assets. Moreover, achieving a consistent 5% return is no small feat; it necessitates strategic asset allocation, ongoing market analysis, and sometimes, timely rebalancing of one’s portfolio.

Furthermore, investors should consider their risk tolerance and investment horizon when employing such strategies. What worked well in 2016 may not yield the same results in today's markedly different economic climate.

Conclusion

In conclusion, the 5% 2016 union coupling reflects an investment philosophy that prioritizes diversification and risk management while aiming for a reasonable return in a landscape riddled with uncertainties. The principles drawn from this concept are as relevant today as they were back in 2016, serving as reminders of the critical balance between risk and reward in investing. Understanding and adapting these principles remain essential for both seasoned investors and newcomers looking to navigate the complex waters of financial markets. As we move forward, investors can glean valuable insights from historical benchmarks like the 5% 2016 union coupling and apply them to current market conditions to better inform their decisions.

-

Tubing Pup Joints: Essential Components for Oil and Gas OperationsNewsJul.10,2025

-

Pup Joints: Essential Components for Reliable Drilling OperationsNewsJul.10,2025

-

Pipe Couplings: Connecting Your World EfficientlyNewsJul.10,2025

-

Mastering Oilfield Operations with Quality Tubing and CasingNewsJul.10,2025

-

High-Quality Casing Couplings for Every NeedNewsJul.10,2025

-

Boost Your Drilling Efficiency with Premium Crossover Tools & Seating NipplesNewsJul.10,2025